When it comes to retirement, the majority of women are on the short end of the stick. In fact, women may have to come up with practical ways to make extra money for retirement.

It’s no hidden secret that there’s a considerable income gap between men and women in most sectors. This gap continues not just till the point of retirement but after retirement as well. Women are also at a higher risk of being financially stranded or burdened due to parenting expenses, divorce, and widowhood.

In fact, according to a survey conducted in collaboration with Ipsos, 60% of women aged more than 60 years were worried that the cost of healthcare would far exceed their retirement income. In light of all of these facts, we would strongly advise you to start preparing for retirement long before you finally bid goodbye to your job for good.

Your Retirement Will Be Here Before You Know It!

A woman puts her family first all her life. Her home and the well-being of her family are always on top of her priority list. However, in keeping everyone first, she often loses herself. All the time a woman could use to make her post-retirement phase comfortable and stress-free gets utilized in ensuring her family gets the best of everything. By the time a woman retires, she doesn’t have much in her bank account that could cover up for her old age healthcare and living expenses.

If you don’t want a life where you’re dependent on your children or benefits and aid to meet your basic expenses, you’ve got to start preparing today. Instead of thinking of what’s next when you’re nearing retirement, start looking at options that’ll help you earn more money that will help you lead a comfortable post-retirement period.

Most of us live paycheck to paycheck, and saving money for retirement from your already limited income might not be the most viable option. If retirement expenses are your concern today when you’re still not too old to work, we say you should pat yourself on the back because you’re on the right track!

This blog post lists down some of the best and most promising ways in which women can earn extra money for retirement.

Rent Out Spare Rooms

Yes, this sounded weird to me when I first learned about it, but then I remembered my oldest son rented a room when he was in college, and he loved staying there. And most people have a spare room or two when their children grow up and move about their lives.

So instead of moving to a smaller house, consider staying in your current house and renting out a spare room or two. Platforms like HomeAway and Airbnb are excellent places to list your property. They connect you with potential renters, and you get to decide everything, from how much rent they pay to what rules you would like the renters to follow. It’s one of the easiest ways to ensure a steady income without having to do much after you retire.

Become a Reseller on eBay

Becoming a reseller on eBay is another way to make extra money after you retire. You can evaluate the market to see what products are most in demand. You can go about flea markets and antique stores and get your hands on unique items that you think will sell at a good price. With just a little investment (if you do it smartly), you can make loads of money. You just need to establish a strong strategy and plunge into the reselling business in full throttle!

[convertkit form=2844806]

Become a Tutor

Is there any subject you’ve got expertise in and can teach? Well, you can consider tutoring after you retire. You don’t have to go anywhere if that’s a concern. You can have students come over to your place to study, or you can teach through Zoom or any other platform. Thanks to the growing trend of virtual learning, tutoring from home is the new norm.

Suppose you want to take tutoring as a full-time profession after retirement. In that case, you can advertise your tutoring services or respond to tutoring job postings on a website like Monster and Indeed.

Pet Care

Are you an animal lover? If yes, you can choose to offer your pet care services for extra money for retirement. You can create your account on platforms like Wag and Rover and list down the pet care services you’re willing to offer along with your charges, preferred times, and all the relevant details.

Did you ever think you could earn money by simply taking someone’s dog out for a walk or looking after them when their owner has to be somewhere important? Would you believe it if we told you that you can earn $30/hour for taking a dog for a walk in New York? Yeah, let that sink in!

Sell Your Handmade Crafts

Is there something in the art world that you’re exceptionally good at? It could be painting, knitting, embroidering, stitching, etc. You might not know this yet, but there’s a massive demand for handmade crafts. In fact, it can be a source of huge income after you retire. What you should do is start long before you retire, make a few pieces every few weeks, and sell them online.

This will help you establish an image and reputation. By the time you retire, you’ll already have a considerable following and customer base. You’ll have all the time in the world after you retire, and that’s when you can create more pieces, sell them, and make good money. Handmade crafts sell at pretty good prices because a lot of hard work and time goes into making them. So, if you’re good at making anything, don’t downplay your skill because it can help you earn money for your retirement.

Check out sites like Etsy, Zazzle, and Red Bubble. I’m familiar with Etsy, and there are people on Etsy who make $5,000/monthly selling their handmade products.

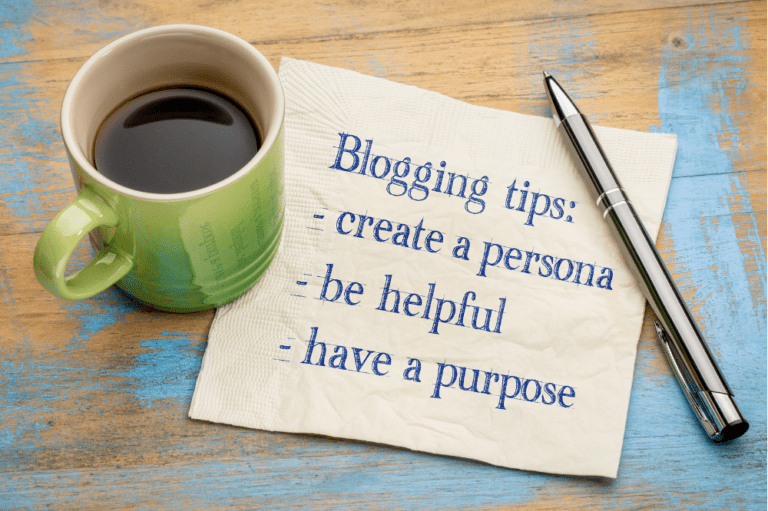

Get Paid for Your Skill

Do you have a skill that can help others in some way or the other? It could be writing, handling social media pages, networking, administrative, bookkeeping, communication, or anything that you think you’re really good at. Simply set up a freelancing profile and start offering your services. You can choose to get paid project by project or task by task. If you’re building a profile on a freelancing platform like Fiverr or Upwork, it would be best if you start long before you retire. It takes time to build a profile, receive client feedback, and get a good rating. The better your rating is, the higher your chances of bagging in larger, higher-paying projects.

By the time you retire, your profile will already be built, and you can save time struggling and start earning right away!

Participate in Paid Surveys

Did you know that you could get paid for participating in surveys? We’re not kidding. You can fill out paid surveys and get paid for simply getting your opinion documented. The more surveys you fill out, the more money you can make. Who wouldn’t like getting paid for doing almost nothing?

Check out Survey Junkie, Respondent, or Just Answer, to name a few. There’s a lot of information online about getting paid to do surveys; however, NEVER pay. If they ask for money, run!

Become a Consultant

You can always start offering consulting services in your career choice. If you’ve worked as an educator all your life, start with education and career counseling. If you’ve worked as a recruiter for your employer, you can start offering your HR consultancy services. In short, whatever your domain and expertise are, you can work as a consultant and help people with your expert advice.

If you choose this path, you might want to check out LinkedIn. Search for people in the same field as yours and check out their profiles. LinkedIn is mainly used for business, so this would be a good place to start.

Offer Child or Adult Care Services

You can work as a child care or adult care professional after retirement if you think you’re capable of looking after someone. Engaging children is something not everyone can do. If you’re good with kids, there’s no reason why you shouldn’t make some money out of it.

Adult care is an equally tough job, but if you think you can do it, why shouldn’t you? Taking relevant training in the adult care domain might help you a great deal and might even earn you an edge.

In Conclusion

Women tend to prefer doing things that they can do from home. Thanks to the ever-evolving technology, there are so many options today. Saving up for retirement from your regular income may not be possible, but having a secondary source of income besides your job is a good way to secure a financially sound future.

Take the bull by the horn and start something today, even if it’s just doing research on anything mentioned here.

But taking action is vital — especially if you want to be able to retire and not have to worry about money.

Have a wonderful day!